FSA: Flexible Spending Accounts

FSA: Flexible Spending Accounts

A flexible spending account—commonly known as FSA—is an employer-provided account where employees contribute pre-tax dollars for authorized out-of-pocket healthcare expenses.

Flexible Spending Account An FSA is a program that allows employees to pay for certain medical, dental, vision, and dependent child care related expenses. - ppt download

Flexible Spending Account (FSA)

LASIK & Flexible Spending Accounts (FSA)

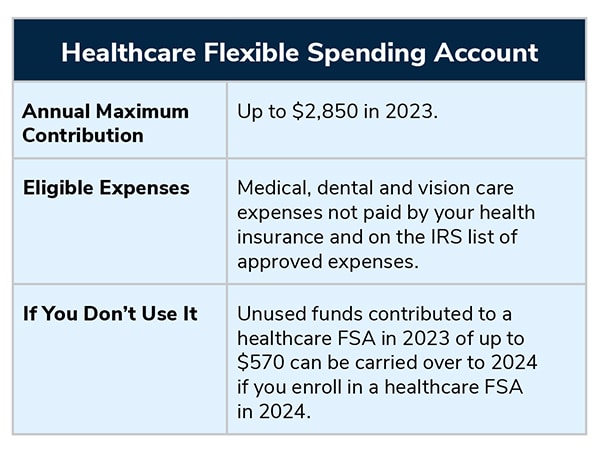

Healthcare Flexible Spending Account – My ACI Benefits

_Work.png?width=1920&height=1080&name=How_Does_a_Flexible_Spending_Account_(FSA)_Work.png)

Flexible Spending Account (FSA) Meaning, How It Works, Pros & Cons

The IRS Use-or-Lose Rule, FSA Account

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings vs. Flexible Spending Account: What's the Difference?

Pros and Cons of Flexible Spending Accounts (FSAs) - Word on Benefits

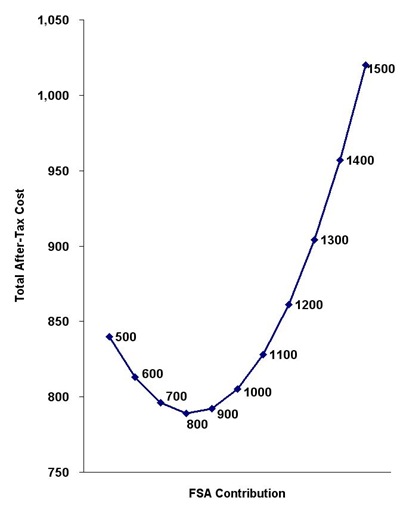

How Much Should You Put Into Flexible Spending Account (FSA)?

Flexible Spending Accounts (FSAs) - A Simple Overview

Is A Flexible Spending Account Worth It?

Remember to use up your flexible spending account money - OBrien Shortle Reynolds & Sabotka, PC