Flexible Spending Account (FSA) Explained

Flexible Spending Account (FSA) Explained

Key points: You won’t owe income taxes on the money you contribute to an FSA. You can use your FSA to pay for your out-of-pocket medical costs. The annual contribution cap is $3,050 for 2023. But it’s not always a good idea to contribute the maximum. Even when you have health insuranc.

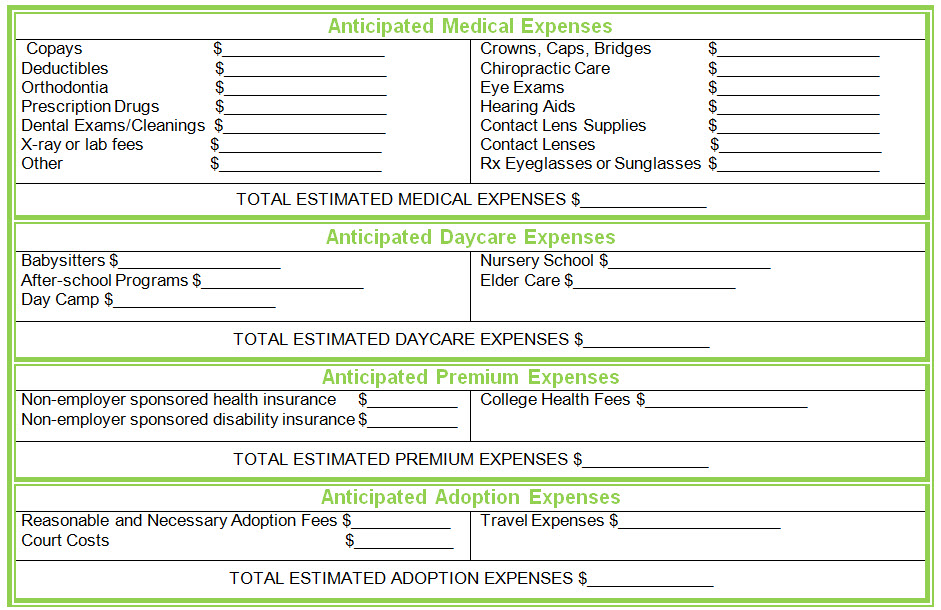

Key points: Even when you have health insurance, you know all too well how out-of-pocket medical costs can really add up. U.S. households spent an average of $5,452 on health care in 2021, according to the latest data made available by the U.S. Bureau of Labor Statistics. That total includes about $1,000 for medical supplies […]

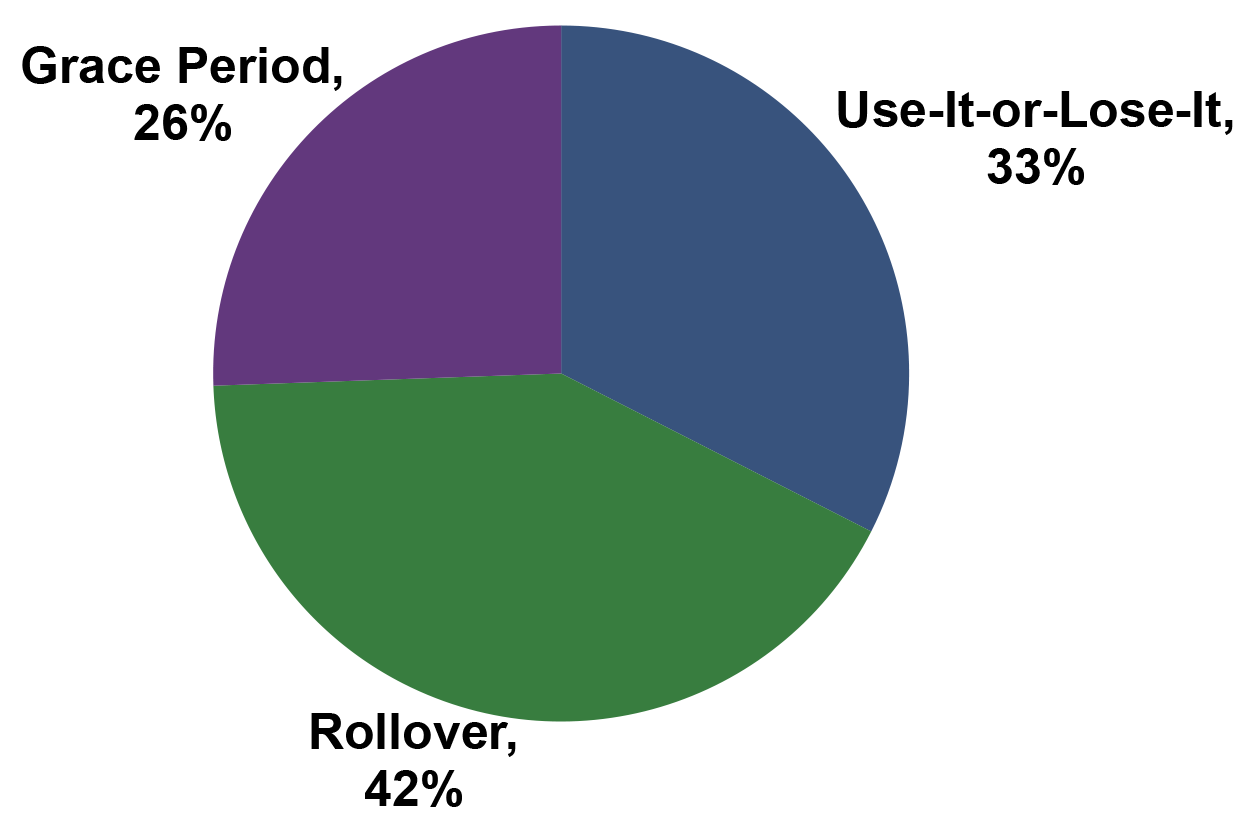

Use It or Lose It! - The Scoop on Flexible Spending Accounts - Goldfarb Chiropractic

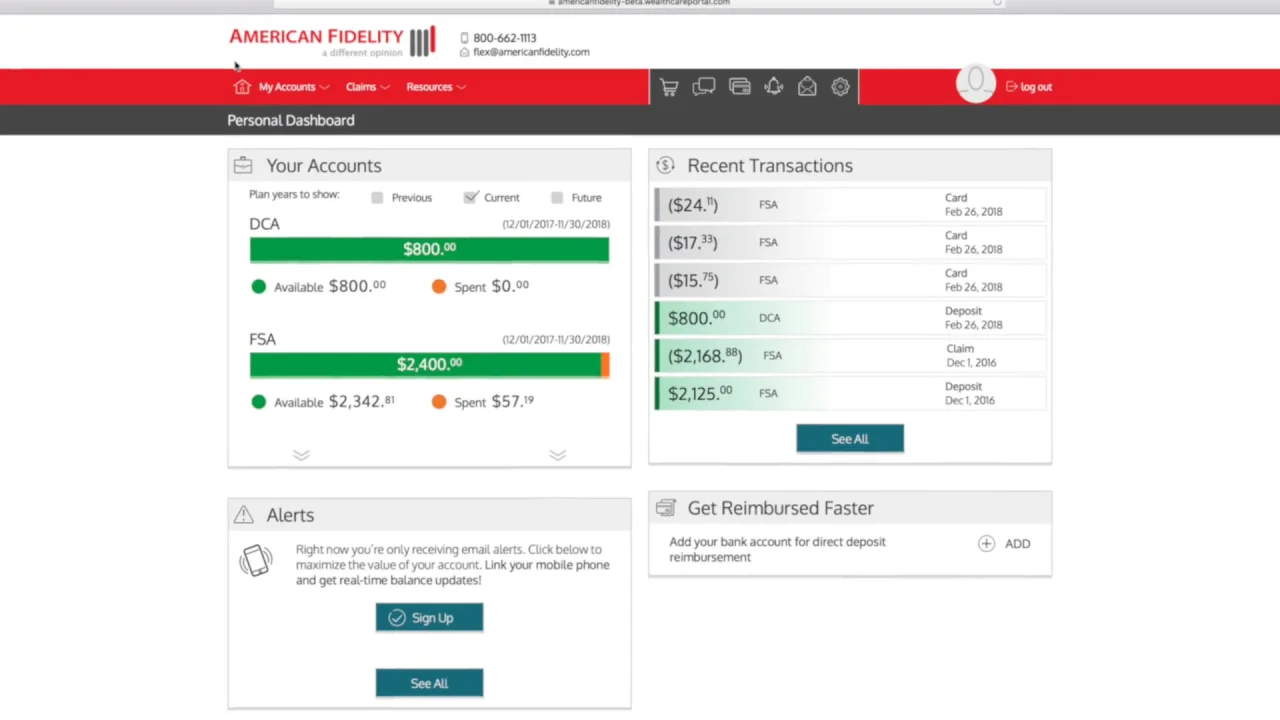

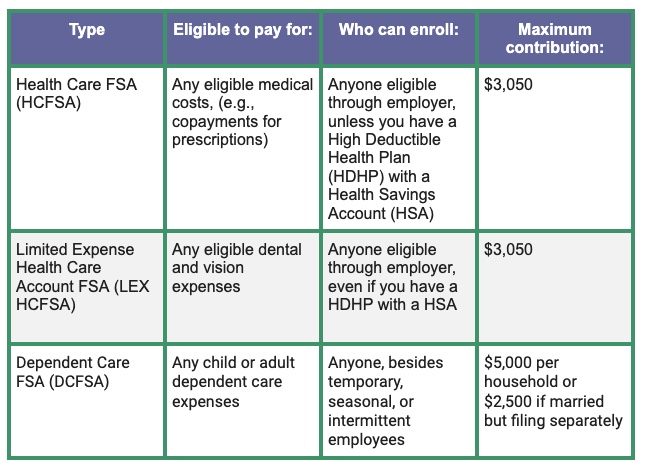

Flexible Spending Account (FSA) (2024)

Health Cards, Healthcare HSA, FSA or HRA Cards

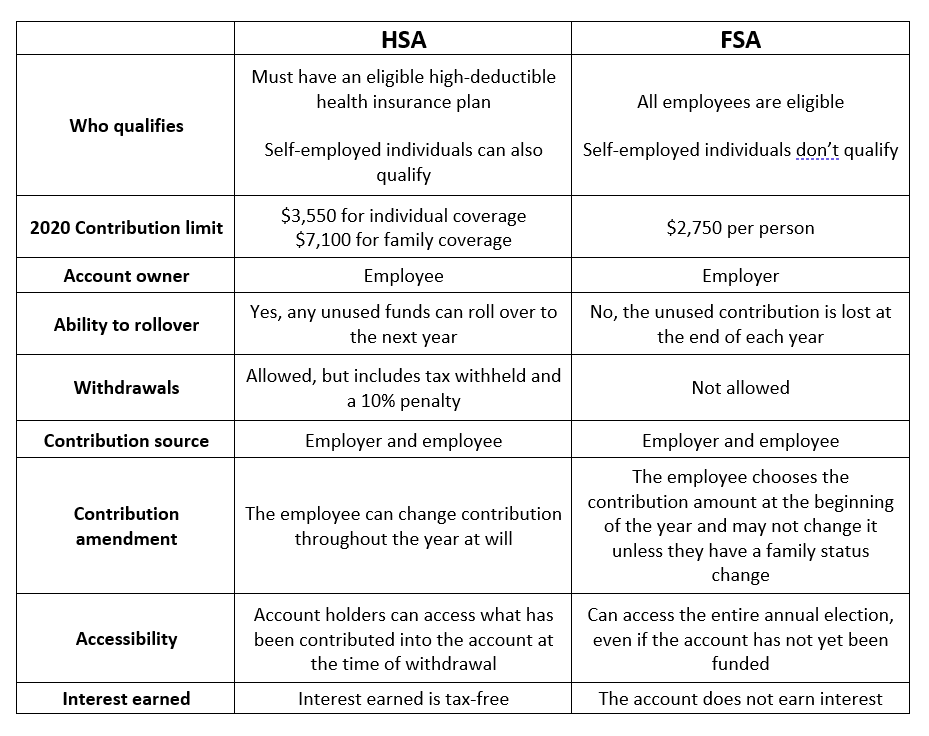

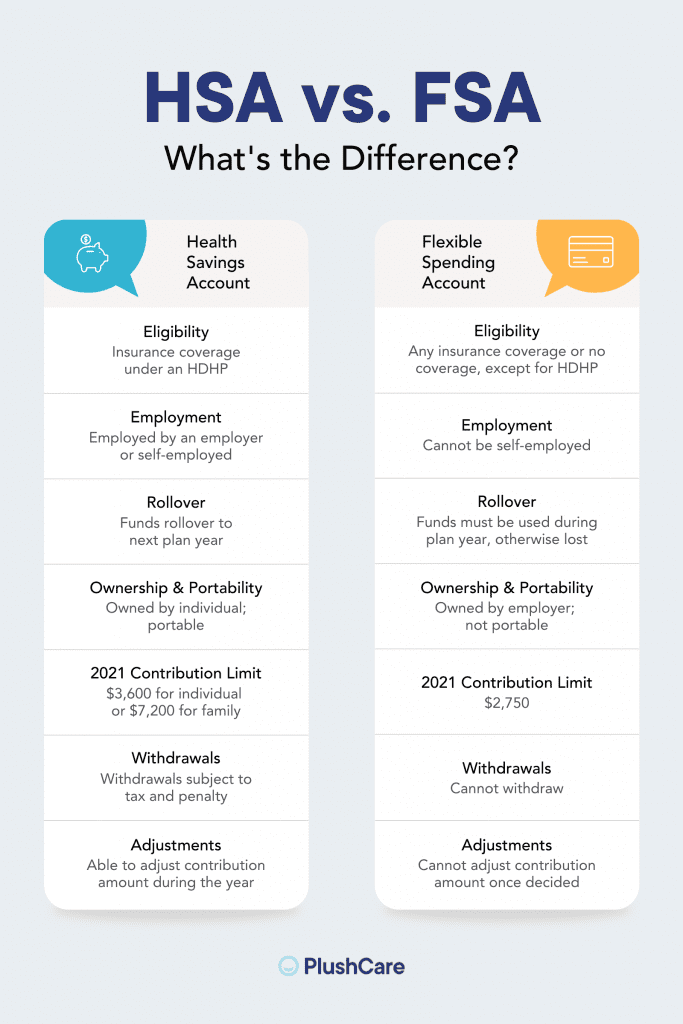

HSA vs. FSA: What's the difference? – The Retirement Solution

Dependent Care FSA Resources

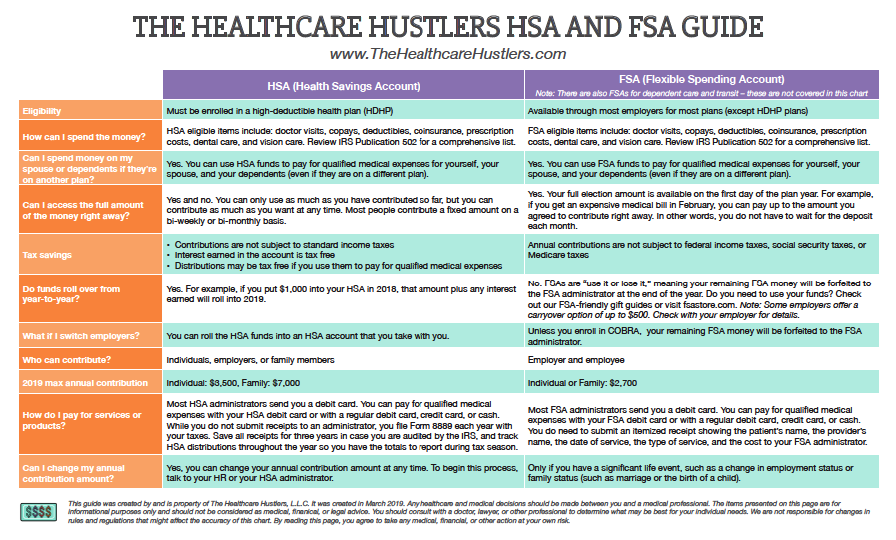

HSA vs. FSA: What is the Difference? — The Healthcare Hustlers

Dependent Care Flexible Spending Account (DCFSA) Overview

Flexible Spending Account (FSA) Explained

HSA vs FSA: What is the Difference?

Flexible Spending Accounts (FSA) - Pro-Flex Administrators LLC

What Is an FSA? Your Guide to Flexible Spending Accounts

Comparing FSA LPFSA and DCFSA - HealthEquity

Flexible spending account (FSA): Eligibility, contribution limits

FSA Database