HSA Eligible Expenses

HSA Eligible Expenses

Chard Snyder is a third party administrator (TPA) of employee benefits plans. Founded in 1988, we provide customized benefit solutions that meet the needs of organizations nationwide for flexible spending accounts, health reimbursement arrangements, health savings accounts, smart commuter, COBRA, and other pre-tax benefits.

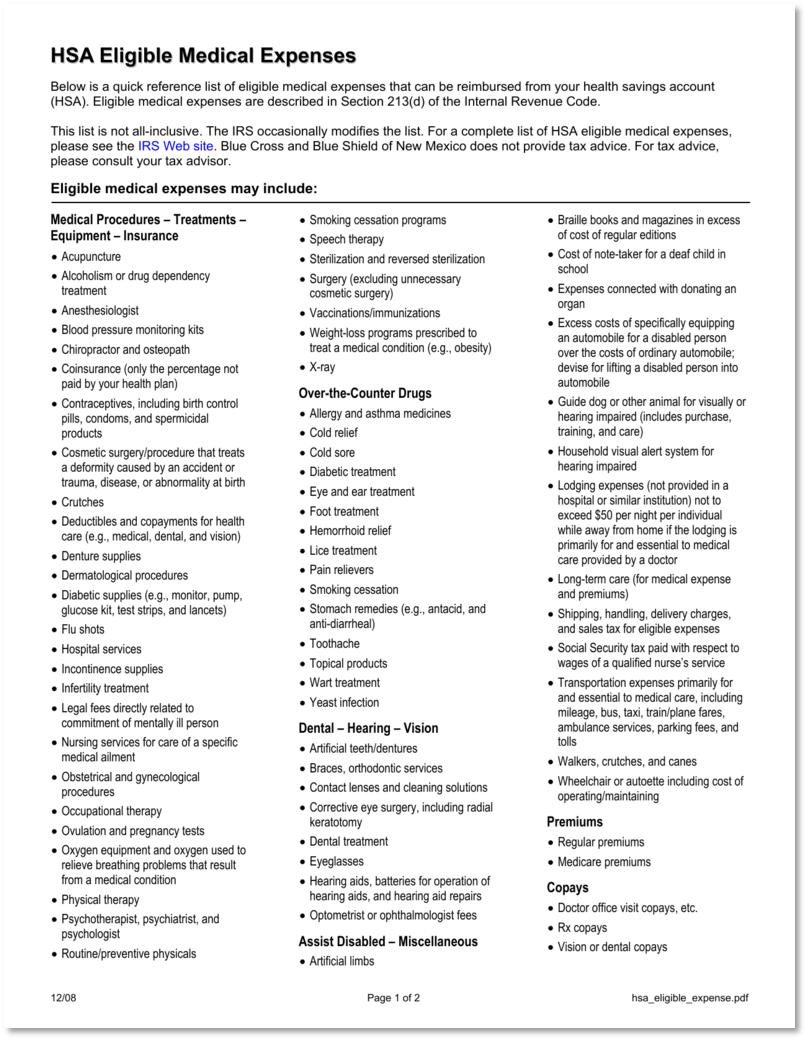

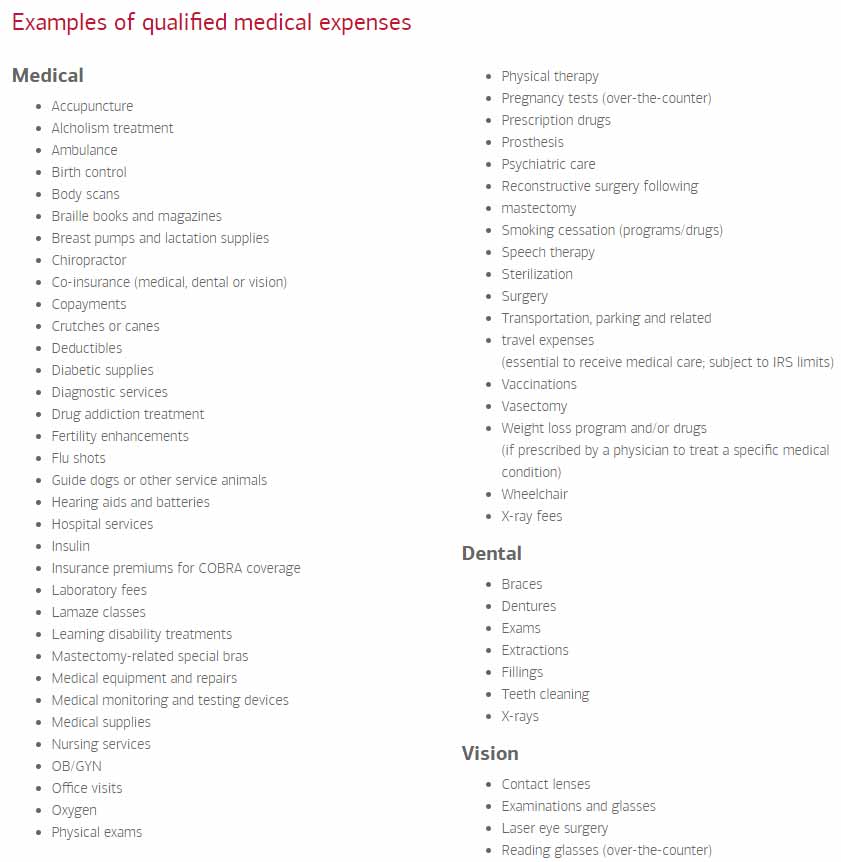

What Qualifies As An HSA Eligible Expense?

2022 Health Savings Account in Nevada - Health Benefits Associates

What Is a Health Savings Account (HSA)?

FSA and HSA Eligible Expenses That May Surprise You, BRI

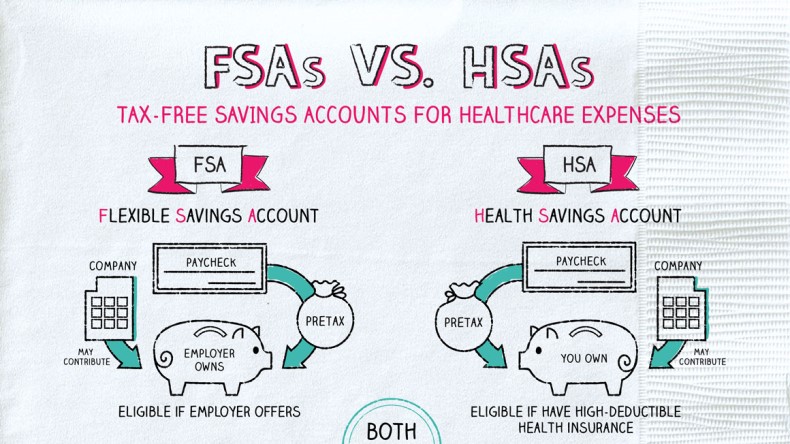

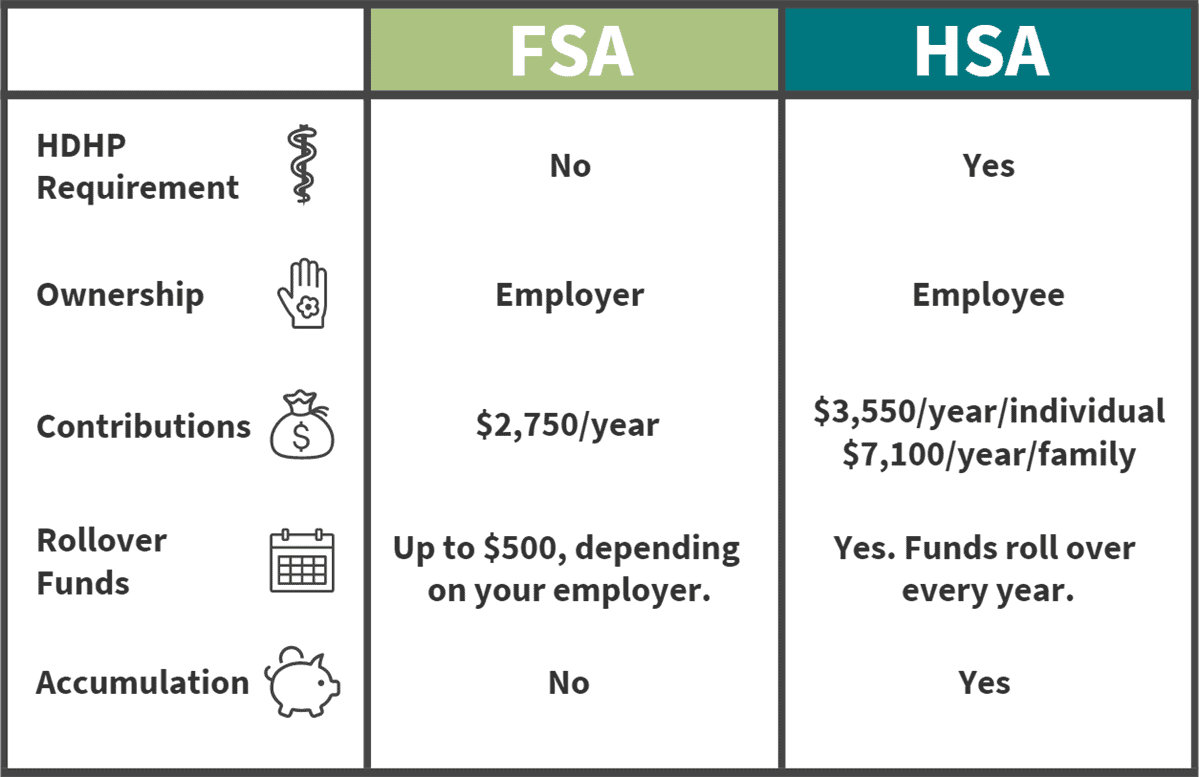

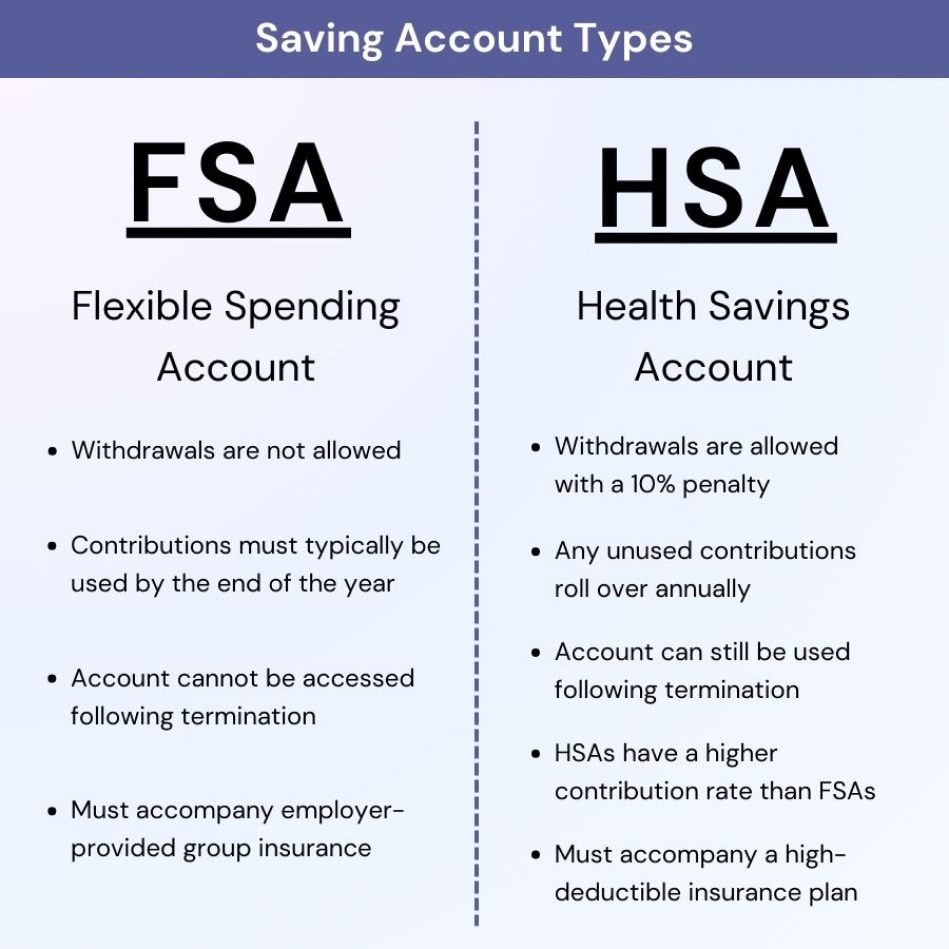

HSA vs FSA Comparison Chart – Aeroflow Healthcare

The HSA Triple Tax Advantage - What You Should Know - Debt-Free Doctor

Eligible Expenses - Health Savings Accounts for Texas School Employees

What are FSAs vs. HSAs? – Napkin Finance

HSA Eligible Expenses 2023: What expenses can you use your HSA for?

What's the Difference Between an FSA and an HSA?

HSA Eligible Expenses

Can I Use My FSA or HSA for Glasses?

HSA-Eligible Expenses in 2022 and 2023 that Qualify for Reimbursement

.png)