Can You File as Head of Household for Your Taxes?

:max_bytes(150000):strip_icc()/headofhousehold-b7e9af51251b46a7a108a878b7cf2da3.png)

Can You File as Head of Household for Your Taxes?

To file as head of household for taxes, you can't be married, must have at least one dependent who lives with you, and must pay for more than 50% of your home costs.

W-4: Guide to the 2024 Tax Withholding Form - NerdWallet

After A Divorce, Who Gets To File As Head of Household For Their Taxes?

Head of Household Filing Status: Definition, Rules and Requirements

Head of Household vs Single- How Should You File Your Taxes

:max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png)

Is the Married-Filing-Separately Tax Status Right for You?

How to File as Head of Household: 14 Steps (with Pictures)

Head of Household vs Single- How Should You File Your Taxes

How Dependents Affect Federal Income Taxes

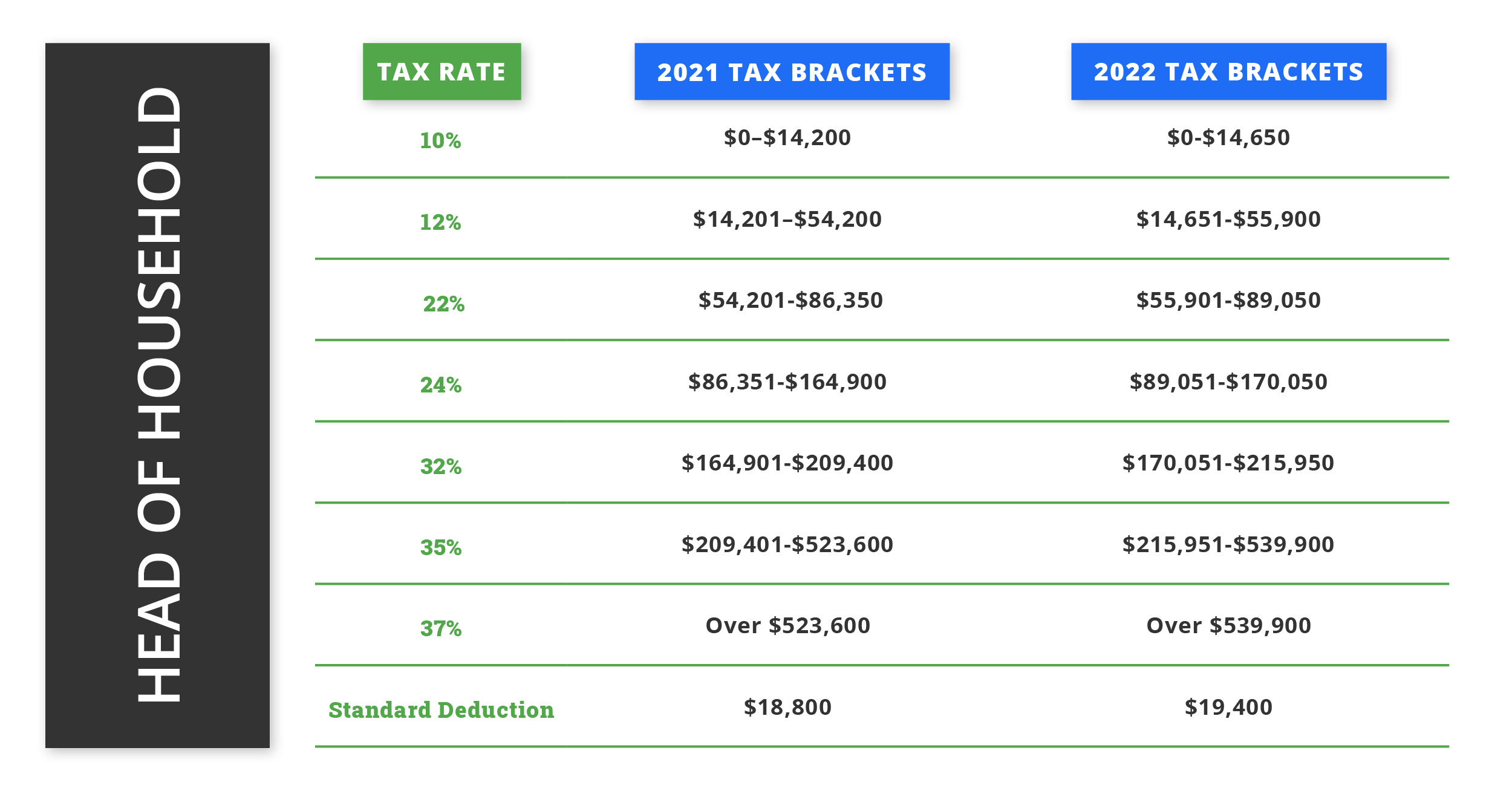

Projected 2024 Income Tax Brackets - CPA Practice Advisor

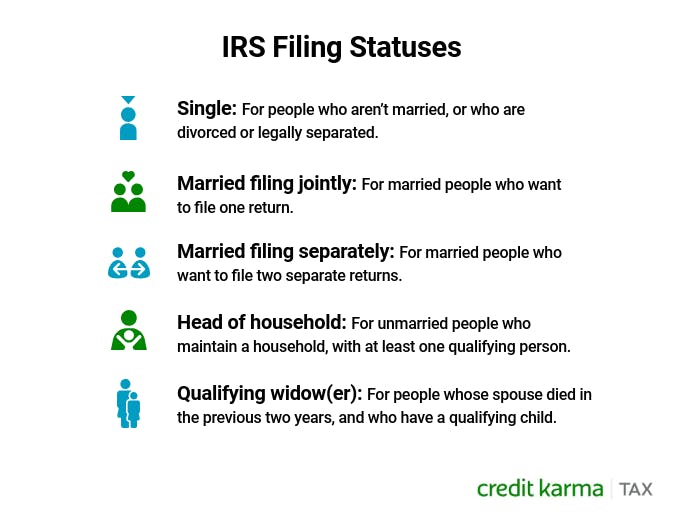

A Breakdown of the 5 Tax Filing Statuses

Filing as Head of Household? What to Know. ׀ Credit Karma